Study: Carrying unsecured debt throughout life tied to poorer physical health

Most people would likely agree that carrying “bad” or unsecured debt—such as credit card debt and payday loans—can be stressful and anxiety inducing.

Now, a researcher at the University of Missouri has found that the stress of carrying unsecured debt throughout adulthood is also linked to poorer physical health conditions, including pain that interferes with daily activities.

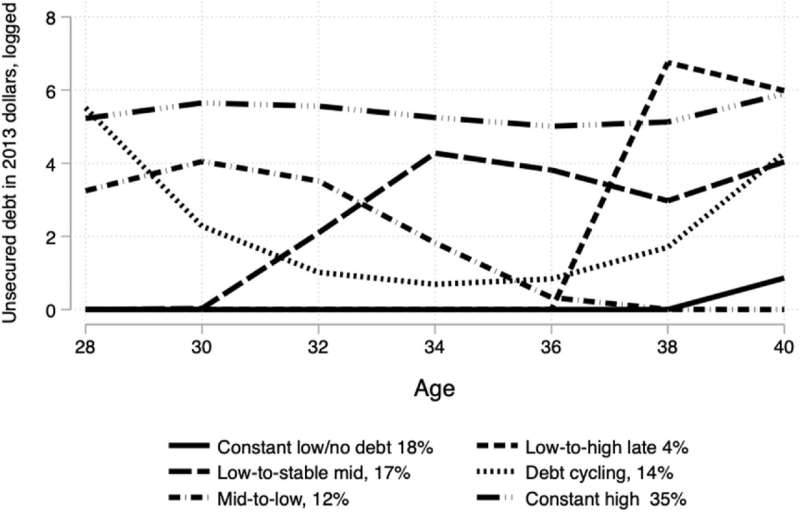

Adrienne Frech, a medical sociologist and associate professor in the MU School of Health Professions, analyzed data from the U.S. Bureau of Labor Statistics to examine the financial health of nearly 8,000 “Baby Boomers’ from age 28 to age 40 as well as their physical health at age 50.

“The most common trend we found was that people who carried their debt with them over time experienced worse physical health later in life,” Frech said. “Those with consistently high debt were 76% more likely to have pain that interfered with their daily life compared to those with no unsecured debt, and what surprised us the most was that even the people who did pay down their debt over time were still 50% more likely to have pain interference than those with no unsecured debt.”

Frech explained that individuals who take on unsecured debt often do so in circumstances of stress or desperation, such as following a medical emergency or having persistently low income even as the cost of living continues to rise with inflation.

“If people don’t have enough money to meet their basic needs, such as food and housing, they tend to take on credit card debt or a payday loan,” Frech said. “The solution is not simply to tell people to spend their money better or avoid medical emergencies—we must address the systematic inequalities that create these desperate circumstances in the first place.”

The connection between unsecured debt and poor health can quickly become a downward spiral. Stagnant wages can lead to people taking on unsecured debt, and the stress that debt causes negatively impacts physical health, which may limit people’s ability to work and pay off the high-interest debt, and the cycle continues, Frech said.

“Both debt and chronic pain can accumulate over time, so this cycle is hard to reverse once it starts,” Frech said. “Ideally, we could prevent individuals from taking on unsecured debt in the first place, and that starts with increasing wages so people could meet their basic needs.”

Source: Read Full Article